The online world looks to be taken over by terms such as NFT and Cryptocurrency.

Even its full name – Non-Fungible Token – seems to provide little clue as to what an NFT is.

Having been in the NFT space for a while now, it took my financial and technical experience quite some time to fully understand the question ‘What is an NFT’.

With the countless hours I have spent in the NFT space, I want to try and relay to you, in the most simplistic way I can, what I have spent months learning.

A NFT (Non-Fungible Token) is a digital asset. This digital asset could be an image or photograph, or it could be other types of digital asset such as music, or a domain name. NFTs are either minted (created) from the creator or purchased on a secondary marketplace. NFTs are risky assets, and their value is driven by demand.

I know this technical ‘encyclopedia-looking’ answer doesn’t give much away, but let’s look at some basic characteristics and examples of an NFT, we will also look at why NFTs are important, and what is considered to be, by some of the experts in the NFT space, the future of NFTs.

The Basics of What an NFT Is

To understand the concept and hype of NFTs it helps to go right back to the beginning – even before NFTs were a ‘thing’.

Trying to understand why a celebrity would pay $300k for an image of an Ape (from Bored Ape Yacht Club) may seem a little crazy, but when you look at it in a different way it starts to make some sense.

The reason some NFTs are selling for the crazy amounts money they are, is because of three key factors:

- Hype

- Exclusivity

- Demand

In truth, these three factors are responsible for the value of many different types of assets to increase, such as art, antiques, comics, wines and more.

Can you or I create an image and sell it as an NFT and make a million dollars? – probably not.

Could you and I come up with a NFT concept, market it well, gain attraction and interest and sell 10,000 of them for 0.06 ETH each (around $100 as of today) and make $1 million – yes possibly.

Although NFTs can come in many digital forms, the most popular right now are digital images, and on occasion photos. NFT Music has also started gaining some topical interest.

The below image is an example of an NFT:

The reason people often invest in an NFT is because they believe it will increase in value over time, and make them money.

This is not always the case though. Sometimes it is to own a piece of art from a particular artist, it could be to belong to an exclusive club or it could be to gain access to a person, tool or software that requires the purchase of an NFT to use – all of which we will look at in this guide.

Right now, 80% of the time an NFT is purchased it is with the understanding (and hope) that it will become more valuable in the future.

The Value of an NFT

The price of an NFT is based on one simple factor.

Demand.

Imagine the price of property. If you put your home up for sale, it will be worth however much someone else is willing to pay for it.

The same goes for an NFT.

If there is demand in the NFT, or the NFT project as a whole, then there will be many buyers. The higher the demand, the higher the price tends to be.

If though there is little demand, and few buyers, then of course the price would be need to be set lower to try and find a buyer, and you may not get back the money you invested.

It’s the basic supply and demand of economics.

An NFT, when created, usually belongs as part of an NFT collection. This is not always the case, but it happens more than not.

The NFT collection is usually promoted and marketed online to potential investors, fans of the brand and through influencers on social media platforms, such as YouTube and Twitter.

An NFT collection will usually have anywhere between 1,000 and 10,000 unique NFTs.

Often, in a collection of this size, each NFT is given a rarity score.

For example, from a 10,000 NFTs collection of cartoon chimps, maybe 3,000 of them are wearing a necklace, which is 30% of the NFTs.

Considering 30% of the NFTs have a necklace, and 70% do not, it makes the NFTs with a necklace rarer.

Now let’s say, out of these 3,000 there may be 2,950 with a bronze necklace, 49 with silver necklace and just 1 out of 10,000 with a gold sparkling necklace.

This means there is just a 1 in 10,000 chance of owning an NFT with a picture of a chimp wearing a gold sparkling necklace.

Considering 99.9999% of NFT holders will not have the sparkling gold necklace wearing chimp, and 0.0001% will, means that particular NFT is very rare.

The rarer the NFT is within the collection the more sought after it becomes, and as demand rises so does its price.

These rare NFTs usually have the highest demand and sell for the highest prices.

If there is a lot of demand for the NFT collection, lots of hype on social media and a general desire to own one within the community you are in, who wouldn’t want to own it.

There is a certain status symbol of being the proud owner of the gold necklace wearing chimp.

Not to outsiders perhaps, but it will to anyone within the industry and the NFT community.

Scarcity, exclusivity, and status symbol act together to create desire. which drives up the price by would-be-buyers outbidding each other to own the most exclusive and rarest items in the NFT collection.

An Example of an NFT

So far, we’ve looked at the basic anatomy of an NFT, and factors that drives its price.

Let’s look an an example to put this theory in to perspective.

Here is an NFT from, arguably, the most famous NFT project on the internet today. The Bored Ape Yacht Club.

The BAYC wasn’t the first NFT project to launch and ‘reach the moon’ (a common NFT phrase used to describe a successful and profitable NFT project).

CryptoPunks is arguably the most famous, and the first, NFT collection. CryptoPunks have sold for upwards of $7 million, but Bored Ape Yacht Club (BAYC as it is known) managed to achieve something different. They managed to attract celebrity influencers.

Celebrities such as talk show host Jimmy Fallon, and rapper Eminem, are now owners of a BAYC NFT. An exclusive club of NFT investors, early adopters and now the rich and famous.

The BAYC project even hosted an exclusive VIP private yacht party for its NFT holders!

This demand, popularity and exclusivity means everyone wants to be an owner of a BAYC NFT in the NFT industry. It is in itself a status symbol for any NFT investor and collector.

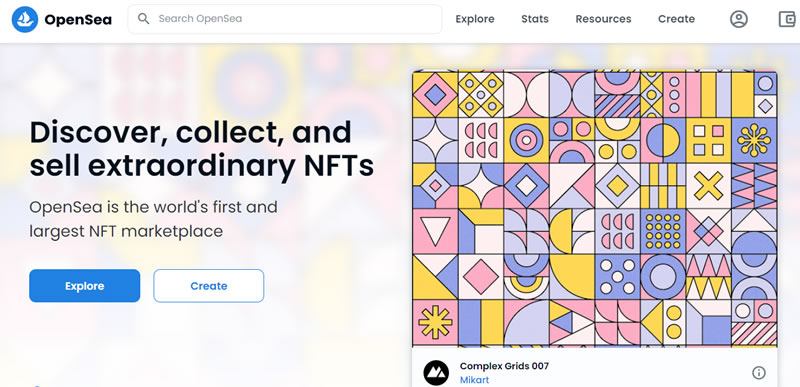

When BAYC NFTs launched you could purchase one for less than $300 – as there was no demand or hype back then. Today the cheapest you can buy a BAYC NFT for on the OpenSea marketplace is 90 ETH (which is around $180,000).

Yes, that’s right. The cheapest BAYC NFT you can buy (a cartoon image of an ape) costs about as much as a house (in some areas).

The Link Between NFTs and Luxury Commodities

If you think the idea of paying the price of a house for an image of a cartoon ape seems absolutely crazy, it’s worth looking at other status symbol assets.

People have for thousands of years collected possessions in a boost to build and increase their status.

Brands such as Michael Kors, Chanel, Nike, Rolex, Lamborghini etc… all fit this category. Owning an item from one of these brands boosts your status, and makes the owner feel as if they are part of a certain club or reach a certain level in society.

Try wearing a Rolex on one wrist, and a Sekonda on the other, and having to give back one of them. Which you give back is up to you. I would imagine not many people would give back the Rolex, even though both watches will serve the same function and tell the exact same time.

It’s the very reason a Rolex are a sought after watch compared to other cheaper makes. This emotional desire and demand is the same reason we see NFTs soar in value.

Owning a BAYC or CryptoPunk NFT is a status symbol of wealth, and to be part of an exclusive club of the rich and famous.

Nothing can explain this concept more than the notion of simply copying a valuable NFT on to your computer.

Right now, all NFTs are shown in their entirety on marketplaces such as OpenSea.

Anyone can copy the NFT and save it to their PC – but what’s the point. You wouldn’t own the NFT.

It’s just a cheap copy that anyone can do. There is no status symbol in that, and it will not fulfill the desire to own it.

The NFT can only be owned by one person and assigned to one wallet (which is where NFTs are stored).

It’s the ownership of the NFT that is the key element.

Anyone can buy a life-size copy of the painting of the Mona Lisa, and also frame it, but if you did you will know that it’s just a copy. Nothing more.

There is no status symbol feeling of owning a real Da Vinci painting if all you do is stare at a cheap copy on your wall every day.

This is same mentality NFT holders have. They want to be the person that owns it.

How to Turn an Image in to an NFT

One common and repetitive question asked time and time again is how to turn a graphic, image or photo in to an NFT.

I mean creating an image in Photoshop or even Paint is all well enough, but how does that image officially become an NFT that can be minted, bought, and sold.

This part becomes a little technical, but in summary:

- You will need an image or photo, and the copyright ownership to sell it (for example, a photo you took, or an image you created)

- You will also need a personal Digital Wallet (such as MetaMask) to store your NFT safely, and hold cryptocurrency so that you can pay the gas fee to create your NFT

- A tool (such as Rarible.com) is needed to take your image or photo, and create a digital NFT token. This gives your NFT a unique digital ‘address’

- You will need to pay a fee (known as a gas fee) to mint or create your NFT. This can be anywhere between $25 to $250+ depending on the demand on the blockchain at the time

- Once your NFT is created it can be listed for sale on an NFT marketplace, such as OpenSea

Here is a glossary that may help translate some of the more technical terms you may come across:

- Mint = to create an NFT

- Wallet = a personal digital storage wallet to hold your cryptocurrency and NFTs online

- Gas Fee = a price to pay for creating and selling an NFT

- Ethereum = the cryptocurrency mainly used for creating and selling NFTs online

- OpenSea = the name of the largest marketplace online, at the moment, to buy and sell NFTs

Why Would Someone Buy an NFT

It may sound surprising that someone would even want to own a digital image or photo.

It’s not as if you can hang them on your wall and admire them.

There are an estimated 2,500,000 NFT owners worldwide. Considering the population of the world is around 7 billion, it means only 0.0003% of people in the world own an NFT.

It isn’t a lot of people.

At the moment NFTs are in their gold rush phase. They are not wildly heard of, very misunderstood and the barriers of entry to own an NFT are high.

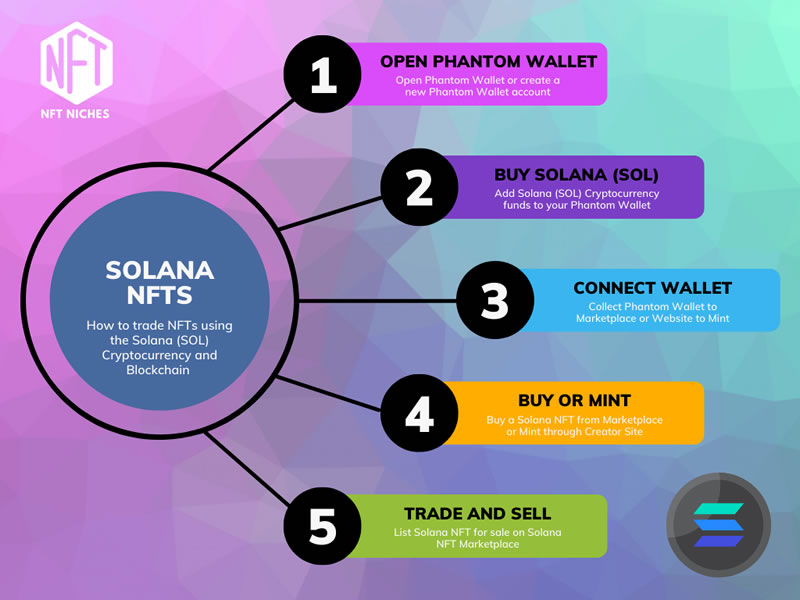

You must own a digital wallet, buy some Ethereum (or other) cryptocurrency, and then either mint the NFT yourself direct from the creator’s website – or purchase the NFT from someone else on an NFT marketplace.

Despite the technical challenges and complexities, still investors, millennial’s, entrepreneurs and even celebrities are throwing their digital hats in to the ring to purchase NFTs and show them off to their followers.

It’s a growing trend right now, and software companies are already looking to make the purchase of NFTs much easier and simpler. As these technical barriers of entry to own an NFT start to fall, this growth trend is only set to continue.

Unfortunately, almost all the new NFT projects launching today will fail. An estimated 98% of them in fact.

This is the stark reality of the NFT world right now, and has a lot of association with the Klondike gold rush.

It’s an unregulated industry. An NFT could be worth $100,000 today and less than $100 in 3 months time.

NFTs as a technology and concept though are here to stay.

What form they will take in the future, no one can really be certain, but the possibilities and the benefits of NFTs are unparalleled to anything else that exists right now.

Are NFTs Risky – Can You Lose Money

NFTs are very risky, and investors can lose a lot of money, and very quickly.

As we have seen, the price of an NFT is based on the demand for it. The higher the demand the higher the price, if there is no demand the NFT is basically worthless.

As an NFT project launches, it’s the founders job is to create as much hype and excitement as they possibly can. They do this by marketing the NFTs using social media promotion, paid promotion and influencers.

Once launch day arrives the excitement of a hyped up NFT collection can turn to disappointment when only 1,000 NFTs sell from a 10,000 NFT collection.

When this happens, there is usually little money to be made, as there are still 9,000 NFTs still unsold and unwanted. No one will pay you more than the selling price for an NFT, if there are still 9,000 that can be bought at that price.

On the other hand, some NFT projects have many more interested buyers than NFTs available, and some NFT projects of 10,000 NFTs can sell out in seconds.

When this happens it usually means there is the possibility to flip (or resell) your NFT on a marketplace like OpenSea and sell for more than you paid, making you a profit.

This is the approach up to 80% of NFT buyers are adopting right now, but you also have the option of keeping your NFT as a longer-term investment.

Most NFT founders create a business startup roadmap, which tells the investor what the project is trying to achieve and their end goal as a business. It is this roadmap that is the reason people invest in NFTs.

If the roadmap is successful, and the project goes on to make a lot of money, this could mean a high return on investment for the NFT holder, depending on the utility on offer.

What is an NFT – In Summary

As we have seen so far, an NFT (Non-Fungible Token) is a digital asset such as an image, graphic or photograph which has the possibility of earning a return on investment.

Although the NFT space is relatively new and largely unregulated – although this is likely to change – it is one set to grow and continue in many different forms, some of which we may not have seen so far.