Trying to find undervalued NFTs is as rewarding and exciting as it is frustrating.

There are thousands of NFT collections and millions of NFTs out there.

As huge a task as it sounds you may notice NFT buyers on Twitter and Discord who are regularly finding undervalued NFTs daily and flipping them for a nice profit.

After spending 6 months deep in the industry and speaking to a number of these NFT buyers the same patterns are emerging. All these NFT buyers are following almost the same logical process and simply repeating.

After trying out these methods and having bought and sold an NFT this week for an 800% profit, I wanted to share these methods and processes.

Undervalued NFTs are simply NFTs that are priced under the market’s valuation. These can be found through rare traits and below floor price valuations for short term flips, or roadmap forecast and founder ability for longer term potential. Undervalued NFTs can provide an average of 436% return.

With so many projects and NFTs it can feel very overwhelming, but the best way find undervalued NFTs is to study and research.

It’s impossible to research every project. Choosing a small number of projects and studying them in-depth, so you understand what makes those NFTs valuable and when an undervalued NFT hits the market, is the way all NFT buyers are constantly flipping NFTs for profit.

These same methods are allowing part time buyers making 1 ETH or more per month in profit, which is the equivalent of around $2,000!

In this article I will explain those exact methods, and how you can start finding undervalued NFTs.

There are two types of goal when finding undervalued NFTs with the intention of buying and selling.

- Flipping for short term profits

- Buying in an NFT to for long term potential

Flipping Undervalued NFTs for Short Term Profit

At present, the majority of NFT buyers are looking for short term flips for fast gains.

Generally, these types of buyers rarely hold on to an NFT longer than week and they prefer to buy low and sell high within 24 hours.

As this is the most common goal of most buyers in the NFT space right now we’ll start looking into this option first.

To buy low and sell high you need to know the tell-tale signs of a collection. The signs that will show either an NFT project has the ability for quick short-term growth or that an NFT is undervalued.

Let’s have a look at the checklist NFT buyers use when trying to flip undervalued NFTs for profit in the short term.

Trending NFT Project Signs

To flip an NFT there has to be demand.

The greater the demand the better. When an NFT Project suddenly has a spike in sales over a short period of time it’s known as a Trending NFT Project.

NFT buyers and flippers are continuously on the lookout for trending projects.

During bursts of demand, it often means an NFTs value can increase 100%, 200%, 500% or maybe more in just an evening. The demand also brings awareness, and once people are familiar and buy in to an NFT they become promoters themselves, encouraging others to jump on board to help increase the price.

How though can you find trending NFT projects?

There are several ways. Let’s look at the most popular and trusted ways to find those trending NFT projects as early as possible.

There are free ways to do this, and tools that can only be accessed through a subscription or by holding one of the tools NFTs in your wallet.

We’ll cover the free tools first to help get you on your way. Paid tools are for experienced buyers, so start with the free tools and see if you can make enough to cover the cost of a paid tool, at which point you will know whether they will be worth it or not.

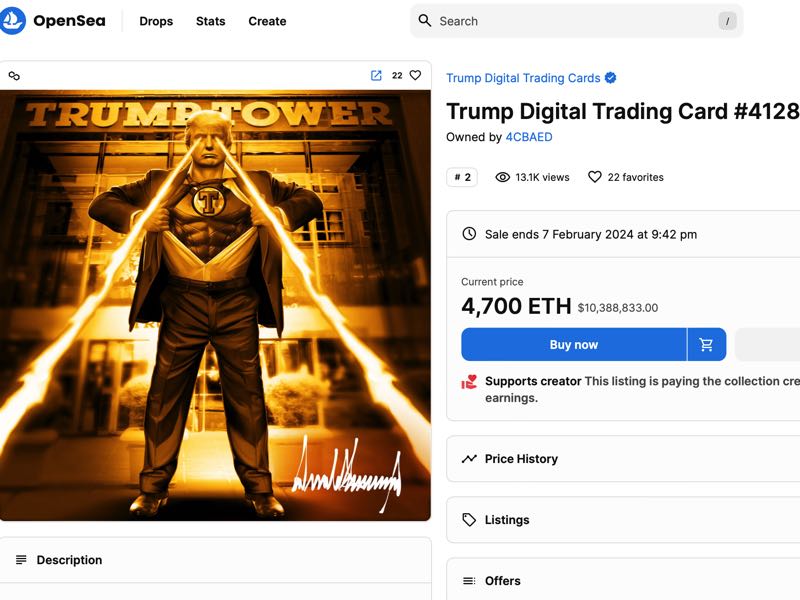

OpenSea – Free

If you have ever bought or sold an NFT before, you are probably familiar with OpenSea.

OpenSea are by far the biggest NFT marketplace on the internet with hundreds of thousands of users, and a multibillion-dollar market capital.

As well as being home to some of the biggest and most popular NFT collections, they also have a trending section.

It is worth noting this trending section usually consists of popular valuable NFTs, the type of NFTs that sell for 2 ETH or more ($4,000+) but this isn’t always the case. There can be hidden gems to be found and accessing this trend section is free.

Visit the OpenSea Home Page and scroll down until you find the Trending section, as show in the screenshot below:

This section can be expanded to see trending NFTs in different sub-categories too.

Twitter – Free

If there’s a trending NFT topic, or a discussion to be had about the NFT world, it will be found on Twitter.

Twitter is the social media home for everything NFT.

This is though somewhere you have to be a little cautious, and not trust everything you see and all tweets you read.

As the NFT industry grew to billions of dollars, it’s somewhere the scammers and fraudsters also turned too.

If you can gather an audience on Twitter (by any means necessary) and build a big enough audience to sell out a 10,000 strong NFT collection for $100 an NFT, it will net someone $1million.

Yes, one million dollars!

The best people to follow on Twitter are those trusted individuals with something useful to add, and with good tips to give, rather than so called ‘influencers’ who have bought most of their followers and do nothing but try to gather followers by offering fictitious whitelist spots and do nothing but promote other NFT projects for a fee.

Known individuals in the NFT space, including holders of NFTs from well-known and respected projects such as Bored Ape Yacht Club and Crypto Punks, are good places to start.

You can also follow the NFT Niches Twitter page for lots of juicy NFT industry news as it happens including the infamous NFT Nightly Numbers.

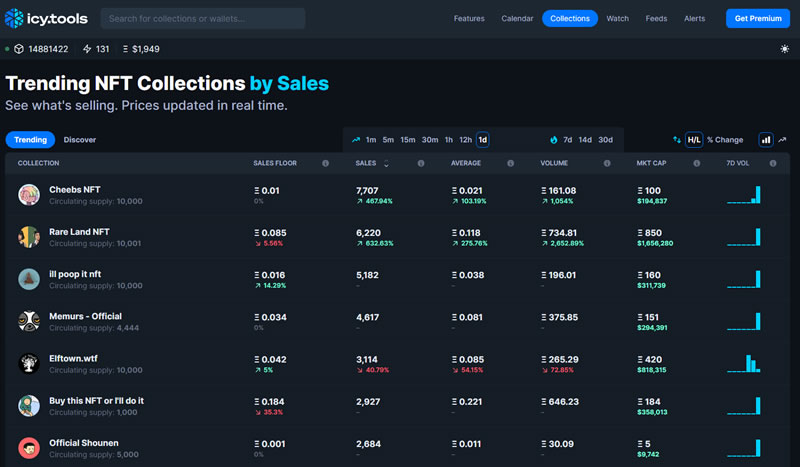

Icy Tools – Free and Paid

As OpenSea and rarity tools such as LooksRare began offering API feeds of their data – which for those non techies is computer jargon for a way to take all the sales and listing information from OpenSea and LooksRare and add that data on to your own site – it meant an increase in the number of NFT Tools displaying that data in multiple different ways.

One such tool is Icy.Tools

Although they offer a Premium subscription with lots of great features, they do provide a lot of useful information for free users.

For example, right from the home page you can see trending projects including latest sales figures, floor prices and how many NFTs sold within 24 hours, 7 days, 14 days, and 30 days.

The amount of data provided is staggering.

Free users have a delay of 15mins of the data they can see. The Premium subscription is required to access real time information, but even a delay of 15mins can provide valuable information.

The home page defaults to the Trending NFT page by default.

Rarity and Trend Sniping

Trying to find those NFT projects that are just about to take off, and provide a 200% or even 500% increase, is incredibly difficult even with the best NFT tools in the world.

There isn’t a setting to show this, as no one can predict the future.

Some NFT buyers spread buy across a few low cost NFTs on the hope one of those takes off.

If they buy 5 NFTs for 0.01 ETH and one collection takes off and they flip for 0.2 ETH, although only 25% of their NFT collection made a profit, this overall sales revenue would be 0.15 ETH – gas fees of course for the buying and listing of the NFTs will need to be deducted to show the profit – but this is a repeatable model.

A much faster way is to buy NFTs with high rarity at lower than market prices.

The people who buy NFTs this way are known as Rarity Snipers.

Rarity Snipers are constantly on the lookout for unrevealed NFT collections that are on the verge of revealing their traits.

Often, and just before a reveal, the floor price can increase and so many people who hold such as NFT make choose this time to sell.

In fact, it’s not uncommon for 30% or more of the NFT collection to be listed for sale at or around the floor price.

Then the moment everyone has been anticipating. The reveal happens.

NFT holders finally find out which NFT they bought, and soon after the rarity of the NFT collection in ranking order is known.

The rarer an NFT the more valuable it usually is.

The moment of reveal can be pre-planned or can happen at a moment’s notice, but if there are 3,000 NFT holders not all of them can be available to check their rankings straight away.

If an NFT holder had their NFT up for sale for close to the floor price, and upon reveal they managed to get a rare item, the low floor price will be available for someone to swoop in quickly and buy before the buyer realizes and raises the price.

This happens on almost every single NFT Collection and almost every reveal.

There are two ways to look for rarity.

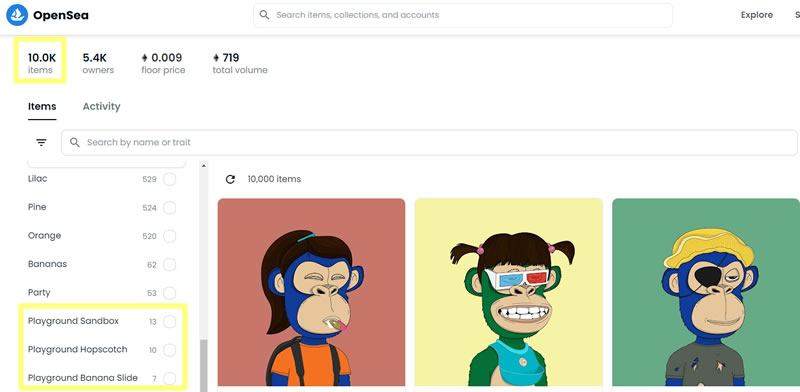

Find NFT Rarity through OpenSea

The first is the free way through OpenSea. As the reveal happens and the traits are known, they will be shown on the left-hand side of the NFT Collections page.

The traits are categorized, and under each category you will see how many NFTs in the collection have those traits.

As an example, let’s look at the Kindergarten Baby Apes NFT page (disclaimer, I do hold an NFT from this collection but considering their goal is to build schools for children, I think any boost to their cause adds value to their cause).

The Background category shows that only 30 NFTs from the collection of 10,000 NFTs has a Playground background.

This ‘should’ make any NFT with a playground background rarer. It’s not an absolute science but the logic works 80%+ of the time.

Find NFT Rarity through a Tool

Many of the NFT Tools now have a Rarity feature helping to see which NFTs are the rare ones in the collection, and if the NFT is up for sale.

These are all-in-one dashboard displays that not only gives you the data without having to manually search for it, but by setting the filters just right, you will be able to set the tool so that no only will it show you the most valuable NFTs – but will alert you if any new undervalued NFTs are listed for sale!

Some of the features of many of the tools can be used free of charge, but for premium features like one click sales and notifications may need to be paid for.

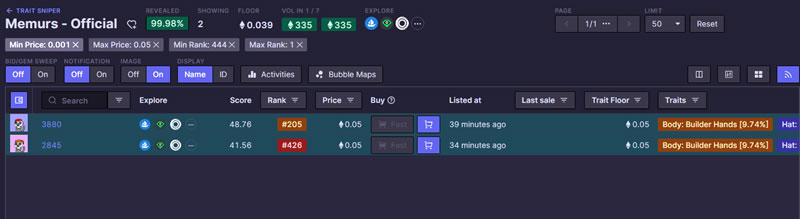

Here is an example screenshot from the Trait Sniper tool. I have filtered the collection to show all NFTs for sale within the Top 10% of Rarity, just 20% above the current floor price to give myself lots of scope to further increase the price:

In this random example, we can see just 2 of the NFTs from the 4,444 NFT collection have a ranking in the Top 10% but with a price less than 20% higher than the current floor price.

This can give an indication of an undervalued NFT, but more research needs to be carried out as to the trend of the project, are more people buying than selling or vice versa, and is there potential for someone to buy this NFT are a higher price than it would be purchased for.

NFT Whale and Sniper Watching

When starting out in the NFT space, and looking to find undervalued NFTs, it can be very tough.

Discord can be both uplifting and motivating when hearing stories of the experienced NFT trait snipers, and whales who buy up everything, making really good quick profits – but equally it can be demotivating when it feels like you’re on an endless research treadmill.

Fortunately, there’s a way to learn from the experts.

Most whales and trait snipers are not so forthcoming with their wallet address but there are free and paid ways to track those NFT whales and NFT trait snipers, see what they are buying in real time, and follow their lead and methods.

The best free way is to look for those who like to share what they are doing. They often leave clues behind as to which NFT they have bought, like the number of the collection, and then by checking OpenSea and NFTGo you can see all the other NFTs they buy, when they bought them and how much they sold them for!

Let’s look at an example of how you can follow NFT whales and NFT rarity snipers for free.

If for example you wanted to track the buying habits of a Bored Ape Yacht Club member, you would start at OpenSea, pick a Bored Ape Yacht Club NFT at random.

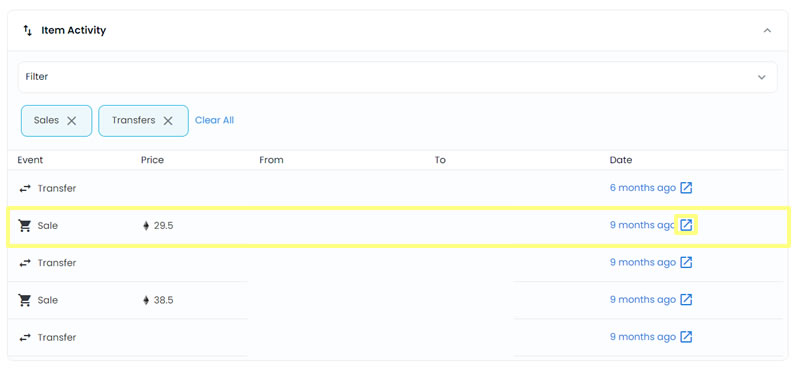

Next, scroll down to the ‘Item Activity’ section to see when the current owner purchased their Bored Ape Yacht Club NFT.

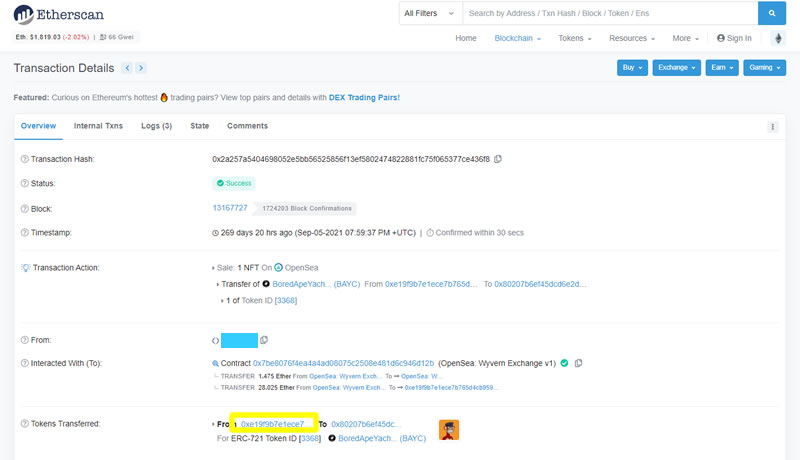

By clicking on the arrow pop out box beside the last activity, you will be taken to a rather confusing Etherscan page with a lot of technical data.

We are looking for the holders Wallet Address, which is found in the ‘Item Activity’ section as shown below

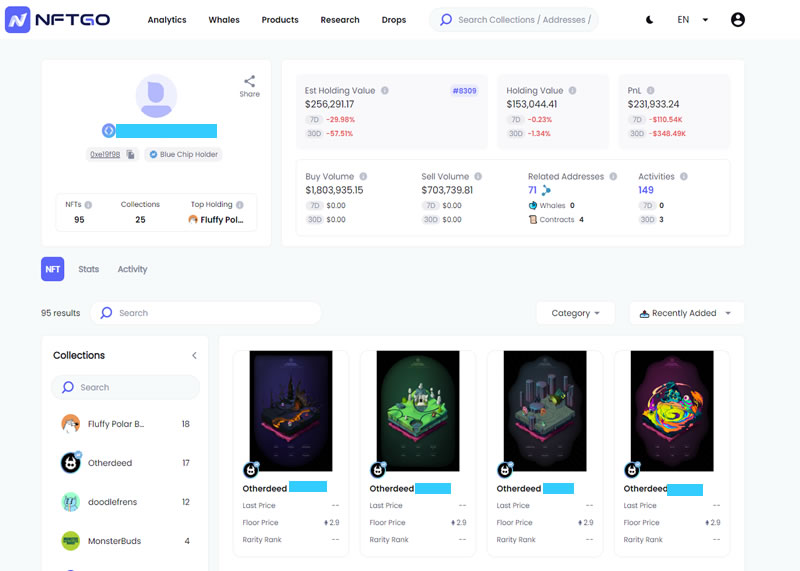

Copy this Wallet Address, visit NFTGo.io and paste in the Wallet Address and search

You will now see all the NFTs this user has bought, when they bought them and an easy way to track how much they bought for and sold for.

It doesn’t take long using this method to find the successful NFT buyers and sellers. Those who have spent months learning the system and have found many of the most successful tactics.

You will want to bookmark a few of these wallets into your browser so you can find easier next time.

This means when a NFT Whale or NFT Rarity Sniper jumps into a project it may be a good idea to focus your efforts doing your own research, looking at the buys and sells, and whether this would be a good NFT project to get in to, and has undervalued NFTs.

Pending Announcements

There’s nothing like hype to drive up a floor price.

If an NFT collection you are researching has put up a post saying they have a big announcement coming, this can often lead to a spike in sales and floor price in anticipation.

The floor price increase can be driven by NFT holders delisting their NFTs from sale pending the announcement.

By delisting their NFTs they reduce the supply of the collection’s NFTs being available for sale by which supply and demand dictates, is enough to start increasing the floor price of the collection.

Fact: The Floor Price of an NFT Collection is the lowest price an NFT in that collection can be purchased for

This could mean those rare NFTs become less expensive and therefore become undervalued.

As an example, if the rare NFTs are selling for 100% above the floor price but the floor price rises by 30% after a pending announcement post, it means the rare NFT is now undervalued.

Setting a notification alarm on the NFT Collection’s Twitter account will help keep you notified, for free, of any pending notifications, upgrades, airdrops or announcements.

Researching Undervalued NFT Projects – The Long-Term Plan

Not every buyer looking for undervalued NFTs are looking for quick and fast projects.

There are many who dive a lot deeper than the surface with research and properly understand the NFT projects long term vision, it’s roadmap, the founders, and their ability to deliver on the project.

These NFT buyers are not trying to predict what the price of the NFT will be in 24 hours or a week, they are looking 6 months to 2 years into the future.

Many NFT projects have a roadmap. A deliverable to buy in to, in which the sale of the NFTs help fund.

If an entrepreneur has an idea for a business, and needs $1million of funding, it can be done with NFTs.

A sell out collection of 10,000 NFTs at $100 (around 0.05, which is cheap for an NFT mint) would provide a starting capital for the launch of $1million – minus expenses of launching the NFT collection of course.

Imagine if Jeff Bezos went down this route, if it were possible, and sold NFTs worth $100 to launch Amazon. Can you imagine the what the value of those NFTs would be worth today if each offered a percentage stake within the business or a shared DAO.

At the time of launch these NFTs would have been incredibly undervalued if someone had seen the potential in Amazon early. This has happened with stocks and shares for decades.

It’s the same concept.

In this section we’ll look at the methods NFT buyers are using to try and predict the probability of the NFT project delivering on its roadmap, and where NFTs today would be seriously undervalued in comparison to how much the NFT could be worth in the future.

The Roadmap

The second most important part to research as part of an NFT project is the roadmap.

The roadmap is essentially the future plan for the business behind the NFT launch. What it will do, how it will do it and in what timeframe.

It’s this roadmap that anyone buying an NFT is buying in to.

The higher profile the NFT collection and the more successful, the more people want in and the higher the price.

Therefore, to find undervalued NFTs for long term potential, it’s important to understand whether the timeframe and project goals are even realistic.

If an NFT project is claiming they are going to build the next Metaverse and is being run by three very inexperienced people with enthusiasm but little skillset, although anything is possible, it is probably going to be unlikely considering Sandbox and Decentraland have launched – and Meta (formerly Facebook) are spending billions on building the same thing.

If though the goal of the roadmap looks probable, possible and fills a gap in the market, it may be a sign the current price of the NFTs are undervalued in comparison to potential future worth once the project delivers.

Who are the Founders – Would You Trust them to Run Your Business

As I mentioned, the roadmap is the second most important thing NFT buyers looking for potentially undervalued NFTs take into consideration.

The most important thing are the founders themselves.

If you’ve ever seen Shark Tank, you will notice that Sharks are as interested, or sometimes more interested, in the founder and people running the business than the business itself.

Many have goals and ambitions of creating the next billion-dollar unicorn business, but only a very tiny percentage of people succeed.

If the founders have experience, knowledge, contacts and can prove they can deliver on the project it puts the business in a very strong position.

Many start-ups launch and sometimes need to pivot. It takes a talented, creative, resilient, and determined founder to navigate through all the obstacles and continue to persevere in times of difficulty.

Those types of founders run successful business.

Founders who do not show who they are (also known as Doxed), or hide behind Avatars, are often hiding inexperience.

Another positive is whether the founders already have a social media following in or around the niche they are launching in to.

This is typically how people who buy shares in a company carry out some of their due diligence, and the same is said for NFT buyers looking for long term possibilities and getting into projects early whilst they believe the NFTs are undervalued.

Founders of NFT projects, if doxed, are usually displayed clearly and prominently on the NFT Projects website.

NFT Community Strength

One advantage NFT buyers have over traditional stocks and shares is the transparency and visibility of the community and audience behind the project.

Almost every good NFT project follows the path of website to Twitter account to Discord Channel.

This is the standard blueprint template being used by NFT projects, and it’s working well.

This means It’s possible to investigate the community supporting the project, whether these are early supporters before the project is launched or NFT holders post mint.

Are the Twitter posts left unloved with few comments, a small number of retweets and a handful of likes?

Are the Discord channels just being bloated by the same few posters?

These are signs of a project that never really gained momentum, or one where people lost interest.

The community can offer such a huge sway as to whether an NFT project is successful or not. NFT holders and project followers can help spread the word and provide strong social media signals – which in turn can convince social media algorithms to show the projects posts to more and more people.

Not only is a strong happy community a backbone to an NFT project, it shows how well the founders are doing communicating with their audience.

A positive strong community is also a good sign of a good founder, which can be a good sign of them being able to successful manage the business – and all of this can point to current undervalued NFTs compared to the future.

Find Undervalued NFTs – In Conclusion

Finding undervalued NFTs can be a fine art, which requires patience, analysis skills and a little fortune.

Whether your goal is to look for undervalued potential for a short-term flip, or a long term return, it is worth noting that 98% of all NFT projects are likely to fail.

With continued due diligence and recognizing the patterns in the successful NFT projects of the past, you can use these indicators to find those 2% undervalued projects time and time again.

None of this of course can be financial advice. It is important you do your own research, your own due diligence and only buy in to NFTs that you feel are right for you and with money you can afford to lose in this very high volatile market.