The world of Non-Fungible Tokens is a largely unregulated one, which is why many people would advise you to steer clear of it. There are many that enjoy the thrills and spills of the tokens, however, still engaging with the marketplace even after being warned about its volatility. This makes it the ideal world for criminals to venture into, with many using the market of NFTs to launder money. The market is almost constantly in a state of flux, whilst regulators are still trying to figure out how to correctly put in place systems to stop nefarious characters from using that fact to their advantage to the detriment of others.

There is also a strong tie between NFTs and crypto currencies, adding a layer of anonymity that lends itself to the work of criminals. The general lack of laws and regulations in the NFT market means that the risk of them being used by criminals to launder money is extremely high. Whilst you might not know you’ve been part of a money laundering process, the reality is that you could be exploited in order to allow someone to ‘clean’ the money that they have gained via illegal methods. If this happens, there is very little that you can do and any loss that you incur would be entirely your own to try to cope with.

Why NFTs Are Perfect for Money Laundering

Art as a whole has long been used for the laundering of money, thanks to the ease with which it can be transported and the opacity of any transactions that take place. Given that that has been the case pretty much since both art and money existed, it is hardly all that surprising that the new world of Non-Fungible Tokens, which many consider to be art, is also being used for the purpose of getting money laundered. The majority of NFT trades take place using crypto currency, meaning that the buyer and the seller can remain entirely anonymous during all stages of the buying and selling process, which is ideal for criminals.

On many platforms where the trading of NFTs takes place, the user does not have to identify themselves. This, combined with the fact that a lot of cryptocurrency wallets also don’t need you to reveal your personal information, means that it is really easy for those committing nefarious acts to use NFT sales and purchases to launder their money. It is also possible to transfer money from one digital wallet to another almost immediately, meaning that law enforcement agencies struggled to seize any money made from ill-gotten gains and find it difficult to trace money as it is moved between locations.

The Subjective Pricing of NFTs

Logan Paul paid $623,000 for this NFT that’s now worth $10 ……

Draw your own conclusions … pic.twitter.com/VCbLVRwpt0

— Wall Street Silver (@WallStreetSilv) September 28, 2022

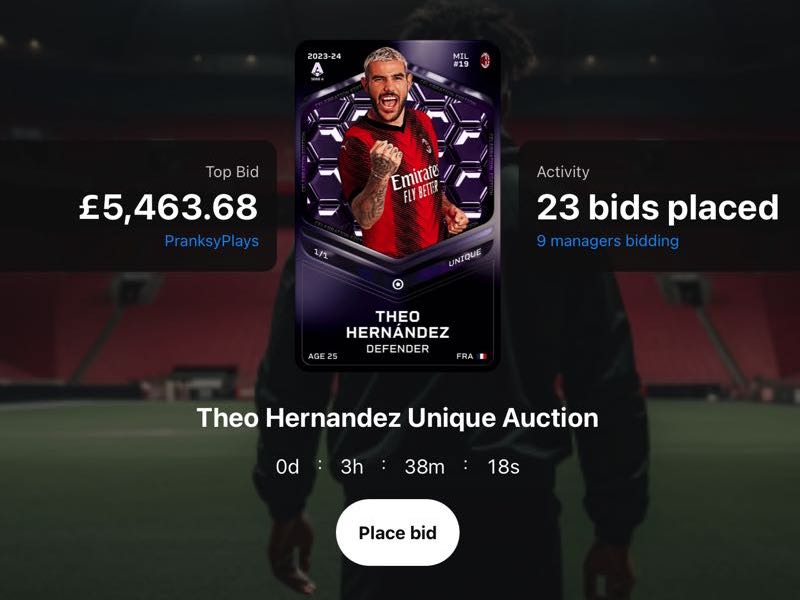

As anyone who has looked at the buying and selling of Non-Fungible Tokens in the past will know, the market is an extremely volatile one. The fact that it is unregulated also means that there is no method of establishing how much one NFT might be worth over another one. The result of this is that the pricing of the ‘art’ of an NFT is entirely subjective. How much one NFT is worth will be entirely dependent on how much someone is willing to pay for it, with no one really able to say that it is a fair price or not with any degree of authority. This is obviously great news for criminals looking to launder their money.

We know that the internet personality Logan Paul bought an NFT from the Azuki collection for $623,000. Within a few months of the purchase, the digital art was worth around $10. No one can say why it is that it was worth one amount of money at one point in 2022 and then worth a different amount a. Few months later, but the volatility of the market means that it is the perfect one in which criminals can operate to launder their money without being caught by the authorities. Methods such as Wash Trading allow them to sell and buy their own tokens, adding value to them and showing a legitimate income source even though dirty money was used.

Is It Possible to Reduce the Risk of Money Laundering?

Knowing that criminals are likely to use NFTs in order to launder money is one thing, but knowing whether there is any way to stop it is something else entirely. The Treasury Department of the United States of America said the following about NFT trading:

The ability to transfer some NFTs via the internet without concern for geographic distance and across borders nearly instantaneously makes digital art susceptible to exploitation by those seeking to launder illicit proceeds of crime because the movement of value can be accomplished without incurring potential financial, regulatory, or investigative costs of physical shipmen.

One of the best ways to stop money laundering is by introducing Know Your Customer policies, which the world of gambling and betting knows all about. Similarly, crypto currency companies could be made to introduce two-factor authentication for customers, which would force them to have more personal information attached to the crypto currency wallets and thereby make it much easier to stop punters from doing something such as Wash Trading. The gambling world is a good one to look to in terms of stopping money laundering, with Anti-Money Laundering measures having been introduced there years ago.

That doesn’t mean that money laundering has stopped entirely when it comes to gambling, of course. There are still numerous companies that are hit with fines owing to a failure to carry out their AML obligations, but the practice is much harder now than it used to be. Whilst the Non-Fungible Token market might take some time to come round to putting methods in place to stop money laundering from happening, the gambling industry demonstrates that it is possible if there is a will. Even if the will isn’t necessarily there, if legislation is introduced to mean that it has to happen then it soon will and examples of money laundering via NFTs will surely drop.