We know many investments fluctuate in price, such as stocks and shares and crypto, but as an NFT is a digital token purchased at a fixed sale price, could its price also fluctuate?

An NFT shares many characteristics to other Web3 assets, but unlike NFTs, cryptocurrencies are traded using a 24 hours a day, 7 days a week trading model.

If cryptocurrencies have trading prices, but NFTs have a fixed sale price, how could the prices fluctuate?

NFT prices can fluctuate for two main reasons. The demand increases or decreases and therefore NFT holders reprice accordingly, or the NFTs blockchain cryptocurrency could increase or devalue. A change in the cryptocurrency price would result in a different USD value applied to an NFT during a sale.

This means if one Ethereum was valued at $2,000 and the next day the same Ethereum is valued at $1,800 it means although the Ethereum price of the NFT may have remained static, the USD value of the NFT has now decreased by 20%.

As an example, yesterday an NFT may have had a selling price of 0.1 ETH worth $200, but today although the same NFT is valued at the same 0.1 ETH price, it is now only worth $180.

The price of the NFT has not changed, but the USD price has fluctuated due to the change of the Ethereum trading price.

Causes of NFT Price Fluctuations

The NFT’s cryptocurrency price, although is generally fixed for a period, is not completely static.

The NFT holder can decrease the sale price in search of a buyer and a quick sale, or could delist the NFT from the market, and list for sale again at a higher price.

This often happens when a surge, or a ‘run’, on the NFT collection happens. As soon as demand increases so does the price, and the reverse happens when demand decreases.

This can be seen by studying any NFT trading chart.

Simply look for many delisted NFTs in a short period of time and this will usually indicate a push in demand, perhaps by an influencers tweet or more utility added by the creator.

On the other hand, a sudden surge in the volume of NFTs reducing in price in the collection and falling floor price is usually an indication of bad news, and NFT holders trying to leave a sinking ship but take as much money with them as they can.

This is due to basic supply and demand economics and unfortunately it applies everywhere, such as oil and house prices, not just cryptocurrency and NFTs.

Are NFT Prices Really Fluctuating?

Whether NFT prices are really fluctuating depends on whether the variances are due to cryptocurrency volatility or NFT demand changing.

It could be argued that if the NFT price stays static it hasn’t fluctuated at all, despite it being worth in terms of USD.

A caveat to note is that cryptocurrency isn’t just traded against the US dollar.

There is a direct comparison against other fiat currencies around the world such as the EURO, or the Great British Pound, or Australian Dollar.

An overall decrease against the US Dollar for example could be an increase against the Canadian Dollar, and all whilst the NFT remains static in price.

According to Zacks.com stocks and shares fluctuate for a number of reasons, including being in a bull or bear market.

There is a strong correlation between the stocks and shares market and crypto and NFT markets.

The NFT industry entered a bear market in Spring 2022, so higher than usual fluctuations in both real cryptocurrency price and cryptocurrency traded price are expected.

Are NFT Price Fluctuations Concerning

Whether NFT price fluctuations are concerning is usually down to the reason the price is changing.

An increase of decrease in the related cryptocurrency price against the US Dollar, for example, is less concerning than a dramatic drop in floor price and huge surge of NFTs in the collection being listed for sale.

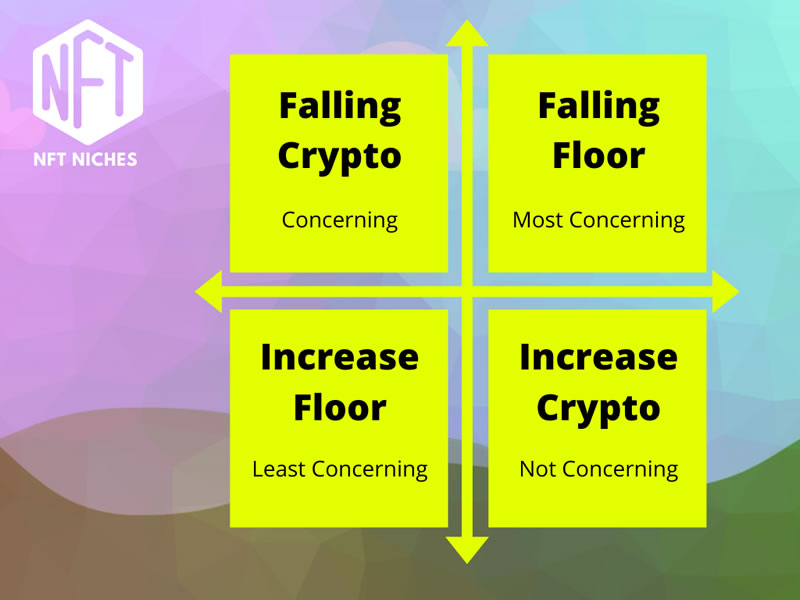

The below infographic helps highlight the situations that can cause NFT fluctuations and which ones are concerning:

The most concerning fluctuation is a sharp decrease in floor price whereas least concerning is a small fluctuation in the cryptocurrency against the US dollar.

As a rule, in the short history of NFT trading a fall in NFT floor price usually follows the reveal of a collection.

A reveal often awards a very small number of NFT holders a status of higher returns or increased utility and often results in most holders, who missed out on the highest benefits available, selling their NFTs to recoup as much of the purchase price as possible.

These fluctuations are quite normal in general NFT trading, although as the NFT industry grows and new sub-niches and methods arise, these patterns are likely to change.

Preventing NFT Price Fluctuations

As a single NFT holder the power to influence price fluctuations is incredibly limited.

In contrast an NFT whale, who could hold a large share of the NFT collection can heavily influence the price.

During 2021 a single tweet by SpaceX and Tesla founder Elon Musk influenced the prices of both Dogecoin and Shibu Inu by large fluctuations.

A report of a Shibu Inu investor with an $8,000 holding managed to see a return of over $1 billion on the back of tweets by Musk.

Unless you have the influence of Elon Musk or Gary Vaynerchuk, the only way to prevent the price fluctuation of a single NFT is to list it for a certain cryptocurrency value – whether Ethereum, Polygon MATIC or Solana – and keep it static.

The US Dollar equivalent value of the cryptocurrency price may alter, but the real NFT price will remain perfectly static until you decide otherwise.

Could the Price of My NFT Change?

No. You have the full control over the selling price of any NFT you hold and can list any NFT for any price you choose,

If you set a price of 0.1 Ethereum today, it will still be for sale at 0.1 Ethereum tomorrow, and next week and next year.

The Ethereum price will only change if you change it.

The market conditions of the NFT collection could change. The average NFT price could, for example, decrease by 20% or increase by 20%, but the price the NFT holder sets for their NFT is down to them.

It’s easy to look at a house price analogy here. The market for homes in a particular suburb could fluctuate and increase with local investment but each homeowner can set their own price for their own home regardless of the price other homes are on sale for in the area.

NFTs holders have full control over their NFTs and choose whether to sell, and at what price.