Since the creation of the first NFTs in 2017 there have been much in the way of media stories about people making a small fortune with NFTs.

Often media can really hype up a situation which can be very far from the truth, but in this case, they have the NFT industry spot on.

Not everyone can become rich with NFTs, but the NFT and crypto sectors have made more people millionaires in the past couple of years than almost any other industry.

NFTs can make you rich. Selling an NFT for multiple times its purchase price or creating and selling an entire collection of NFTs are the two main ways. Creating wealth through long term NFT investing is a trending strategy but although NFTs can make you rich, it is possible to lose everything invested.

Buying and investing in NFTs, like cryptocurrencies, is a very risky investment strategy.

98% or more of NFTs on the market will lose money, so the secret of becoming rich with NFTs is to continue to buy and invest in the 2%.

It is of course easier than it sounds but there are strategy processes being followed, and working, for many NFT buyers that continue to add wealth to their NFT portfolio.

In this article we will look deeper into case studies of how people are becoming rich with NFTs, how you can follow the same strategies and how to avoid the most common NFT buying mistakes.

How NFTs can make people rich

There hasn’t in recent times been a method of making people richer in such a relatively short space of time than NFTs and Cryptocurrency.

It may sound far fetched that someone could invest $1,000 today and see a return of $100,000 in less than a few months, but not only did this happen several times over but some NFT investors saw even higher returns than this.

To understand how NFTs can make people rich it helps to look at the NFT ecosystem.

In fact, there is a very easy explanation as to why this is happening right now and why this trend can not continue at the pace and rate it is – although the bear market of 2022 has reset the clock back a little.

The NFT market hit a perfect (good) storm creating the industry it has, and there were five main factors:

- New technology-based industry

- Bitcoin hyper growth

- Covid lockdowns saw people spending less, saving more, and having more cash to invest

- Continued Bull run in the investment market

- Social media driven hype

The NFT industry being such a new technology meant money invested was very low.

Huge NFT brands today such as Bored Ape Yacht Club and Crypto Punks were given away in the early days to help drive demand to the projects.

As each NFT collection is finite in size it means as demand grows, and supply does not, prices naturally increase.

After a major shoe manufacturer purchased a Bored Ape Yacht Club, as an experiment of sorts, for $150,000 and the news hit the headlines.

What was a gimmicky industry full of techies and early innovators suddenly, through the power of the media, caught the eyes of investors.

Money poured into this new industry like a never-ending cascading waterfall, far exceeding the amount of money already circulating in the space.

There were a lot fewer NFT collections then than there are today. With a small supply and a sudden huge increase in demand it increased the prices the NFTs in those collections dramatically.

With money flooding in, prices increased over the hype. It drove more attention and further hype as NFTs started hitting the market with seven figure price tags – and were selling!

2% of NFTs will Make People Rich

Any growing industry with investment flowing and buyers increasing will naturally see an influx of suppliers.

Many more NFT collections appeared trying to capitalize on the early successes of other collections.

The increase in supply saw some NFT collections reduce in value as money spread across collections in search of the next Bored Ape Yacht Club.

There have been recent successes such as Moonbirds, VeeFriends, and GoblinTownWTF which became the first NFT collection to break free of the rather clumber-some Discord grinding, utility offering, roadmap waving standards buyers were used to seeing.

None of these collections have risen to the levels seen in Bored Ape Yacht Club or Crypto Punks but in Spring 2022 some free mints of GoblinTownWTF NFTs would go on to sell for around $12,000 just a few short weeks later.

This is nothing though compared to owning a Crypto Punk in 2017, which was also a free mint, and selling for over $7million a couple of years later.

Gary Vaynerchuk, an internet marketing guru and NFT enthusiast, recently said that 98% of NFTs will fail.

Becoming rich with NFTs is all about finding the remaining 2%.

NFT Strategies for Wealth

There are three current strategies to become rich with NFTs.

Every person who became rich with an NFT or NFT collection would have used one of these three strategies we are about to look at in detail.

Flipping NFTs

To flip an NFT means to buy and sell in a relatively short amount of time when either the NFT is under priced, which is then resold at market value creating a profit, or to buy an NFT on the expectation of an increase demand in the short term, to then resell for a profit.

For example, there are NFT tools available such as Icy.tools and BlockProbe.io that helps find undervalued NFTs These are valuable NFTs that a holder may not realize what they are holder and sells for less than market value.

The NFT holder may not necessarily undercut the floor price (the price of the lowest priced NFT in the collection) but the NFT may have rare traits that are in demand.

Savvy NFT flippers are seeking out those NFTs using automated tools, which are automatically looking for undervalued rare NFTs, buy them quickly and can resell within a matter of hours for hundreds of dollars in profit or more.

On the other hand, some NFT flipping strategies rely on intuition and getting in early on NFT projects they have made calculated assumptions on a potential short term large growth.

If they purchase the NFT for 0.1 ETH but believe the project will reach 0.3 ETH, they will buy in now and then sell (flip) for 0.3 ETH when the floor reaches this price.

It sounds like guesswork but there are often patterns to be found in NFT collections that do grow, and patterns to be seen in NFT collections that fail. Startup investors use the same process, they will see patterns in which startups grow and succeed and which fail and invest in those more likely to succeed.

Long Term NFT Investing

To attract buyers many NFT collections have a long-term roadmap.

A roadmap is simply the path the business behind the NFT collection is going to take to create a profitable business, that can then give back to those people holding one of their NFTs.

NFTs can be a method of crowdfunding.

10,000 early investors of $300 can create a $3million startup fund for entrepreneurs to create the business and achieve the goals set out on their roadmap.

If a buyer believes in the business, the founders, and its future potential, they could buy in now for $300 with the potential the NFT price increases dramatically in the long term once the business is built, running and is profitable giving back to the NFT holders.

Imagine being able to turn back the clock and investing in Amazon, Google, Uber, or Meta (formerly Facebook) by buying an NFT for $300.

How much could that NFT be worth now!

This strategy relies heavily on doing thorough due diligence on not only the business idea, it’s industry and growth potential, but also its founders.

The right mix can turn a $3million funded startup in to a multi-billion-dollar business, and it is these NFT projects long term NFT investors are searching for to become rich.

Selling NFTs

Selling out an NFT collection is by far the fastest and most likely way to become rich with NFTs.

Buying NFTs can produce small profits in the short term and potentially good profits in the longer term but selling out an NFT collection can make the founders millionaires overnight.

This strategy is really how someone becomes rich with NFTs!

The challenge with NFT project founders is marketing their NFT collection and making it stand out amongst all the other NFT collections looking to do the same thing.

It’s possible to create and launch an NFT collection and make over a million dollars in 24 hours BUT only if you can convince enough buyers to buy from you.

There are tools that can create a 10,000 NFT collection in a matter of minutes.

There are also tools that can create the software (known as a smart contract) for your NFTs to be purchased.

In fact, I could create an NFT and list on OpenSea for sale in under 30mins. I already have.

With such a low barrier to entry it means thousands of entrepreneurs are looking to make those riches seen through the hype of social media posts and media stories by creating their own NFT project and collection.

It’s a tough industry but those with the creativity, imagination and right storytelling can change their lives and fortunes dramatically!

Suggested Reading – if you are interested in starting your own NFT project we have put together the ultimate guide to creating art and selling an NFT which can be found here.

NFT Millionaire Case Studies

To best illustrate what we have looked at so far, let’s look at some NFT case study of how NFTs have made people rich over the past few years.

We’ll look at a case for buying and selling NFTs to show it’s possible using both methods.

Crypto Punk Holders

I have mentioned the Crypto Punks collection a couple of times in this article, and we are about to look at why.

Crypto Punks is considered the first NFT collection to launch. The collection minted out in 2017.

Crypto Punks were given away for free, and already there have been several Crypto Punks which have sold for more than $1million, making the holders of these NFTs very rich!

The highest selling Crypto Punk is #5822 which sold for $23m!

The early adopters in to NFTs and into Crypto Punks have seen an incredible return in profits and has made every NFT holder rich.

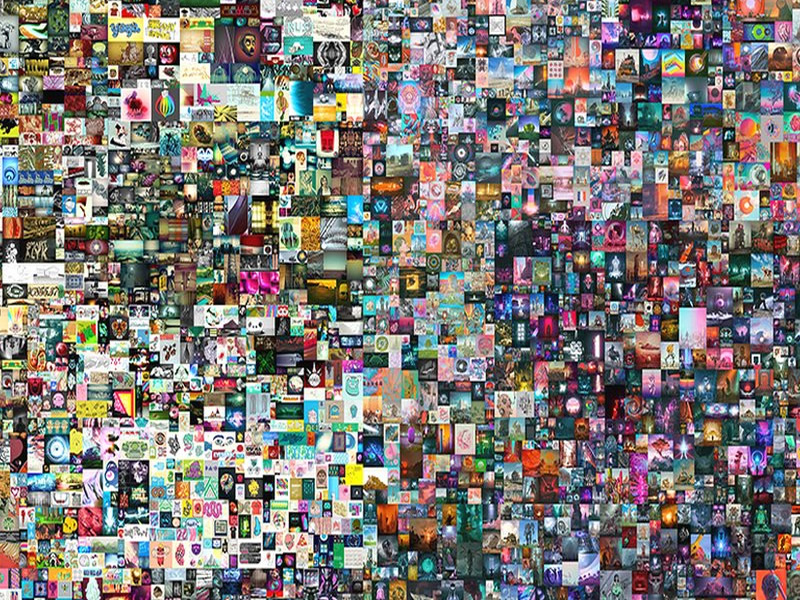

Beeple

For those of you not familiar with Beeple (here is a helpful link to his Wikipedia page under his real name Michael Winklemann), he is famous for selling the highest priced single NFT.

It sold for $69m!

Beeple is a famous artist and had a following. He managed to turn his fanbase and collection of art in to a highly valuable NFT which drove a selling price to $69m in auction.

You can find out more about Beeple’s incredible $69m sale and the NFT involved here in another article we published.

Beeple became very rich selling an NFT and he isn’t the only one.

GoblinTown WTF

You do not need to be a famous artist to sell an NFT, or sell out an NFT collection, for over a $1million.

Creativity, a brand, and a story could be enough.

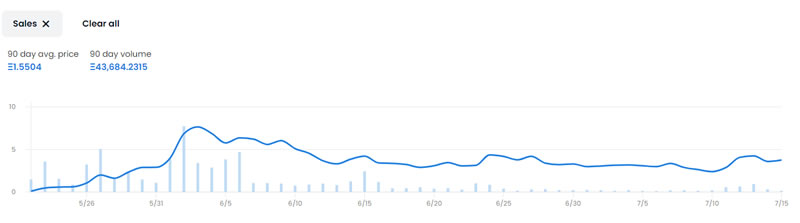

It is estimated that Truth Labs, the company behind the GoblinTownWTF collection have made over $4m in royalties on the back of their free mint, which has seen a huge number of goblin related NFT copycats looking to repeat their success.

It wasn’t their first successful NFT launch either.

A quick glance at the project may have people wandering what all the fuss is about, and how ugly looking NFTs with no roadmap, no utility, no rewards, and no Discord channel (which almost became standard for NFT collections) could succeed and do so well.

Look deeper and you’ll see how clever and creative this NFT strategy was.

Here is a graph showing the floor price of GoblinTownWTF NFTs over just a three month period from launch:

They solved major issues people were becoming frustrated with in the NFT industry, created an incredibly detailed brand and delivered with such clever artwork.

It’s ugly but in a cleverly designed beautiful way.

We are in the process of creating a full in-depth review of GoblinTown WTF and how it became successful, but this is an example of clever creativity in the NFT space, thinking outside the box which gave their founders millions of dollars.