With NFTs, the Metaverse and Cryptocurrency constantly in the media and with huge NFT valuations quoted, it is leading many to ask whether NFTs are simply overhyped and overpriced.

In the heat of a hyped-up moment, the feeling of status when paying $500,000 for a cartoon digital ape may seem great, but will the novelty wear off.

And to quote Jeremy Irons in Margin Call, ‘Is the music about to stop playing?’.

We have been studying the NFT market for well over a year now.

Our Twitter page (@NftNiches) has many posts showing how we monitor those projects with great launches, those with the quickest and highest growth and also NFTs to watch out for.

With hundreds and hundreds of hours of NFT project analysis, we can explain to you our thoughts – based on this knowledge – as to whether NFTs are just too overhyped for the market to exist in the long term.

Some NFTs are overhyped and overpriced. These NFTs are typical those purchased based on the status of ownership without having real intrinsic value or historical significance. NFTs selling consistently at a steady floor price with utility and benefits of ownership, tend not to be overhyped or overpriced.

For those curious about the NFT space and what it may hold for the future, we have put together a useful guide to help explain what is happening in the market right now and what could easily happen in the forthcoming year, two years and five years ahead.

What is an Overhyped and Overpriced NFT?

An overhyped and overpriced NFT is one which sees the market value decrease over a short period of time.

Overhype creates an unrealistic bubble of long-term expectation, which often pops once the market of the NFT project is realized.

Hype around the NFT collection by either the creators, paid influencers, supporters or other NFT holders creates an artificial view of demand.

This artificial view leads the buyer to believe there is a lot more demand, and greater need to own the NFT, than reality would suggest.

The NFT buyer is sucked into the hype, buys the NFT and soon realizes the demand has disappeared or the demand wasn’t really there to begin with.

At this point the NFTs value decreases, other NFT holders of the project all try and undercut each other to make a sale in an attempt to recoup as much of the purchase price as they can – and another NFT projects floor price decreases dramatically.

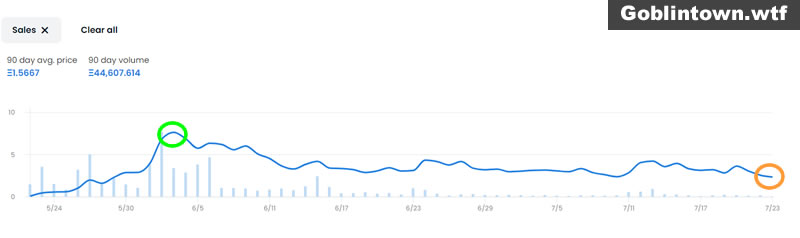

To illustrate the point, here is a floor price chart for GoblinTown.wtf. This NFT project’s demand and hype was crazy in Spring 2022 and made the company behind the project over $4million.

As you can see, the floor price dramatically increased after the launch, and after an announcement tweet by a well-known NFT influencer on Twitter (which was later deleted!) but since, as the hype has started to diminish whilst people look for other opportunities, the price is now decreasing.

It has fallen by more than 50% from the highest Ethereum price it achieved.

Considering the value of Ethereum dramatically decreased in the bear market of summer 2022, it has meant the dollar value of each Goblintown NFT has fallen by almost 80% from the highs it achieved.

It could be argued that without a real benefit of holding such an NFT, apart from it being used as a status symbol, it could suggest that these were overhyped and overpriced.

I do want to mention that Goblintown.wtf is a legitimate project, with an incredibly talented and clever team behind them. Referring to them as overhyped and overpriced is an example of how the market reacts to such projects, not a reflection of the project itself.

Why are NFTs Overhyped

NFTs are overhyped for one reason. To increase demand and increase their value.

If you hold an NFT, and knew in advance that the value of your NFT will increase if you just promote and join in the hype, would you not do it?

This is what is happening.

A few people start hyping a project which can create a domino effect leading to more people on social media promoting it. This perception of high demand can skew the true market picture.

Add an NFT influencer into the mix, and the hype can increase at a ridiculously high rate.

With a finite supply and an increase in demand it will naturally increase the NFTs worth as the economic buy and sell floor price seeks equilibrium.

The hype around most NFT projects will either quickly disappear after the project mints, or shortly after the project reveals.

Also, after 2-4 weeks the hype around the majority of NFT projects will be non-existent. Unless there is value in holding the NFT such as a tool, service, staking with benefits etc. the status of owning the NFT will simply disappear.

Therefore, the price will reduce.

NFT projects all started to launch using a similar framework throughout 2021.

The launch strategy followed a process similar to this – the project was announced on Twitter, Discord channels were later added, whitelist spots were given, hype, hype and more hype were fueled from within the community, and the project launched.

There was often so much hype and drive from within Discord communities that anyone inside could well believe everyone in the world wanted in.

This was rarely true and is more evidence of artificial demand.

To anyone inside the community, owning the #1 rarest NFT in the collection was the biggest status accolade any community member could be given.

They became the envy of the rest of the community.

No one outside this adrenalin fueled community were particularly interested though, meaning after the hype went away no one was left wanting to buy.

We have seen this on many occasions, and it’s estimated 98% of all NFT projects will be forgotten about, and will become worthless in less than 12 months from the date of launch.

Smart NFT buyers ignore the hype and do their own research and due diligence based on facts and patterns rather than hype.

The Effects of an Overhyped NFT

There are a few after-effects of an overhyped NFT to a collection, and to the industry as a whole:

Floor Price Rollercoaster Effect

Overhyped NFT projects often follow a very similar pattern, referred to as the Rollercoaster Effect.

This is where demand for an NFT starts low, rises incredibly high before coming crashing back down again.

Just like a rollercoaster!

The best NFT projects will only see either a small decline in floor price, or the collection will go on to increase their value further.

What the floor price is showing is an artificial hype. Created within by the community, driven by FOMO (Fear Of Missing Out) with a limited timeframe of appeal.

It isn’t impossible for the value of NFTs in the collection to rise again, but it often needs a big announcement, large partnership, or a high-profile person such as an influencer backing the project.

Negative Perception of the Industry

Unfortunately, the methodology used by NFT projects since NFTs launched back in 2017 has been based on attracting a flipping market.

80% of all NFT buyers are not investing for long-term holding, or an interest in the community or art, they are there to make money fast.

These are buyers who want to make 100% profit in days or even hours and looking for any opportunity to do so.

It really is the wild west. The Klondike gold rush is a very good comparison here.

Investors in stocks and shares are often happy with a S&P 500 return of 10%-20% per year on average over a 10-to-20-year run.

Dividend stock investors look to make up to 8% passive income return per annum.

NFT buyers are different. They are not looking for 8% or even 20% returns, they want 100% to 1000% returns, and very quickly.

This has led to a lot of inflated hyping, scammers, rug pulls and smart contracts that can clear out your entire crypto wallet simply by the wallet owner clicking on an unscrupulous but innocent looking link.

This has cost some victims of millions of dollars in digital assets such as cryptocurrency and NFTs.

It is no longer safe to hold cryptocurrencies and NFTs in online wallets such as MetaMask, it is much safer to hold your assets in offline secure wallets.

The combination of heavy losses in the NFT space, along with constant scam tactics, is creating a very negative perception of the NFT industry.

High Risk Association

If the rug pulls and security concerns weren’t already bad enough for the NFT market, the Bear run is really hitting the industry hard.

Although the stocks and shares markets are down globally, they haven’t seen the dramatic declines both the cryptocurrency and NFT industries have.

NFTs are heavily linked to cryptocurrency of course, but any high-risk investment is usually the first type of investment people pull out of during uncertain times.

High risk also means less buyers and investors, which is not great for the NFT ecosystem.

Overpriced vs Market Value

To understand whether anything is overpriced a simple look at the volume of sales will tell all.

Market value assets sell. Undervalued assets sell – but overpriced assets do not sell.

This same rule applies to all assets including NFTs.

There has been a steady decline in NFT sales throughout 2022, but the bear market saw a decline in all investments including stocks, shares, and cryptocurrency.

The riskiest investments will always be hit first and hit hardest.

There is often a misconception that things are overpriced based on how affordable it is in the eye of the beholder. What can be overpriced to one person is good value or even a low price for another.

Take for example concert tickets. The face value is often affordable but the secondary market sales can be eye wateringly expensive.

Front row tickets for a top name artist can be priced at many thousands of dollars.

Overpriced, yes?

To someone with no worries about money and has plenty of it, this could be of great value, or even considered cheap for the experience.

If someone can afford to pay $20,000 for a Las Vegas suite for a single night, paying $1,000 for front row tickets for their favorite artist may seem incredibly cheap.

When looking at NFTs it is important to check recent sales, and whether the NFTs are still being bought at the list price.

If there are regular sales then the NFT is not overpriced, if the NFTs in the collection rarely sell then it could mean the NFT is overpriced.

Today, NFTs are still trading. Projects are still minting, and buyers are still buying.

Until NFT sales stop altogether the NFT industry is still operating at market value.

Conclusion – Are NFTs Over-hyped and Overpriced?

Based on analysis and research there are many NFT collections that have been overhyped and were overpriced.

Quite a number of them in fact.

This doesn’t mean though that the entire NFT industry is overhyped.

The NFT space got off to a bad start with digital cartoon memes and images. This has set the industry off on the wrong foot.

This was never the intention of the technology behind NFTs.

The Wild West period looks to becoming to an end and new emerging innovative and new NFT strategies have already started to enter the market.

The NFT industry will start to make better use of the blockchain technology and smart contracts.

Although, there is a risk to the NFT industry as it stands. It’s unregulated. That’s the idea behind a decentralized system, but the decentralized system filled with anonymity has led to a huge number of scams leading to many NFT holders to lose a lot of money.

Imagine banks allowing anyone to hack into their system and take people’s money, and if it happens, they shrug their shoulders and say ‘oh well, it’s how things work around these parts’.

This is literally what is going on in the NFT space right now.

A certain degree of trust and security must enter the market first before NFTs can truly achieve their potential.

NFT digital cartoon characters are in the main overhyped and overpriced, but the NFT industry is just getting started.

Or maybe we are just believing our own hype!